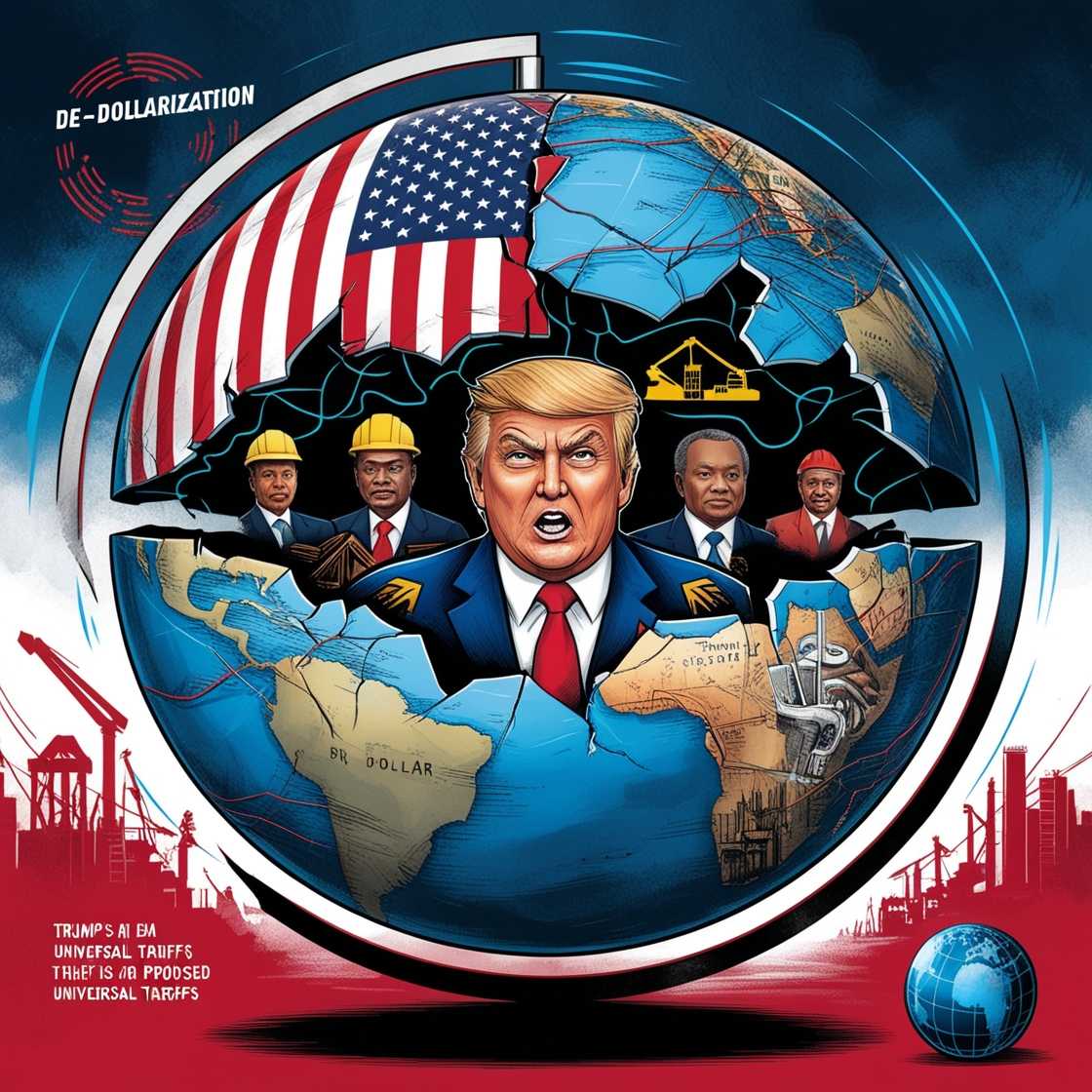

Trump’s Tariff Strategy and BRICS Push Against the Dollar

Overview of Trump’s Proposed Tariffs

Former President Donald Trump has proposed a new round of tariffs to reshape America’s trade policy if he returns to the White House. Dubbed the "universal baseline tariff," this policy seeks to impose a uniform tariff on all imports, departing from previous administrations' country-specific and industry-specific tariffs. The goal is to protect domestic manufacturing and reduce dependency on foreign goods, but critics warn it could disrupt global supply chains and lead to retaliatory measures from trade partners.

The Global Push to De-dollarize

The BRICS nations (Brazil, Russia, India, China, and South Africa) are amplifying their efforts to reduce reliance on the U.S. dollar in global trade. This de-dollarization strategy includes exploring alternative currencies and strengthening regional trade agreements. The bloc’s initiative reflects growing frustration with the dollar’s dominance, which many countries see as a lever of U.S. geopolitical power.

Key Developments in De-dollarization

- BRICS Currency Plans: Discussions of a unified BRICS currency continue, aimed at facilitating trade within the bloc and reducing exposure to dollar volatility.

- Bilateral Trade Agreements: China and Russia, among others, have signed deals to settle trade in their national currencies, bypassing the dollar.

- Gold Reserves Growth: Central banks in BRICS nations are significantly increasing gold reserves, signaling a shift toward hard assets as a store of value.

Implications for U.S. Trade and Economy

Impact of Universal Tariffs

Trump’s tariff proposal, if implemented, could reshape global trade dynamics.

- Domestic Effects: U.S. manufacturers could benefit from reduced competition with imports, but higher costs for goods may burden consumers.

- Global Reactions: Major trading partners may retaliate, imposing their tariffs on U.S. exports, potentially leading to trade wars.

- Supply Chain Challenges: A uniform tariff could disrupt the complex global supply chains U.S. businesses rely on, leading to higher production costs.

Risks of De-dollarization

The U.S. economy could face long-term challenges if de-dollarization gains momentum.

- Reduced Global Influence: A decline in the dollar’s role as the primary reserve currency could weaken America’s economic leverage internationally.

- Capital Flow Impacts: Decreased demand for dollars could lead to reduced capital inflows into U.S. markets, affecting investments and interest rates.

Strategic Considerations for the U.S.

The U.S. must balance protectionist trade policies with strategies to counter the BRICS de-dollarization push. Enhancing multilateral trade agreements, fostering innovation in domestic industries, and maintaining diplomatic engagement with allies are critical steps to navigate these economic challenges.

Conclusion

As Trump advocates for sweeping tariff reforms and the BRICS nations accelerate efforts to reduce dollar reliance, the global economic landscape is poised for significant shifts. The interplay between these policies will shape trade relations, economic growth, and geopolitical power in the years to come.

More Article:

1. Trump’s Tariff Strategy and BRICS Push Against the Dollar

2. Mastering Sports Betting Odds

3. Michigan vs. No. 2 Ohio State Live Updates: Wolverines Lead 7-3